Cut Employment Taxes with the S Corporation

Tax PlanningIt gets to the point where enough is enough.

As the owner of an unincorporated small business, you may be at that point with the self-employment tax.

For 2022, lawmakers levy the self-employment tax at the painfully high rate of 15.3 percent on the first $147,000 of your net self-employment income:

- 12.4 percent for the Social Security tax component and

- 2.9 percent for the Medicare tax component.

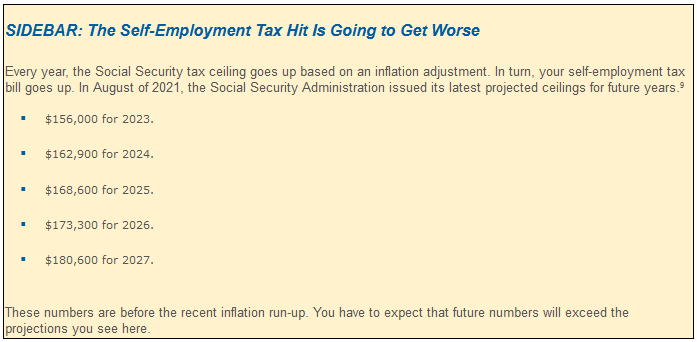

The $147,000 Social Security tax ceiling is up from the $142,800 ceiling for 2021, and that ceiling will only worsen. See the SIDEBAR at the end of this article.

Above the $147,000 Social Security tax ceiling, the Medicare tax component of the self-employment tax continues at a 2.9 percent rate before increasing to 3.8 percent at higher levels of net self-employment income, up to infinity, thanks to the 0.9 percent additional Medicare tax.

Of course, you already know all that! But we occasionally need to take a fresh look at a situation to appreciate how dire it has become.

Say your self-employed Schedule C income for 2022 will be $200,000. After multiplying the $200,000 x 92.35 percent on your Schedule SE, you find that your 2022 self-employment tax bill will be a whopping $23,584.

Oof! That’s a lot of cash down the chute! As the SIDEBAR at the end of the article shows, the Social Security Administration forecasts that the Social Security tax component of the self-employment tax will quickly get much worse.

Have you reached the self-employment tax tipping point? If so, this article shows you how to cut employment taxes with an S corporation.

Federal Employment Taxes at the S Corporation Level

For W-2 compensation paid in 2022 to an S corporation employee, including an employee who also happens to be a shareholder, the FICA tax rate is 7.65 percent on the first $147,000:

- 6.2 percent for Social Security tax and

- 1.45 percent for Medicare tax.

Above $147,000, the FICA tax rate on the employee drops to 1.45 percent because the 6.2 percent Social Security tax component cuts out. But the 1.45 percent Medicare tax hits compensation up to infinity, increasing to 2.35 percent at higher compensation levels thanks to the 0.9 percent additional Medicare tax.

On the S corporation employer side, the S corporation employer pays the same Social Security and Medicare tax that the W-2 employee does.

Therefore, the combined FICA and employer rate for the Social Security tax is 12.4 percent, and the combined rate for the Medicare tax is 2.9 percent, increasing to 3.8 percent at higher compensation levels—this is the same as the corresponding self-employment tax rates.

That’s the bad news.

Good News: The Split

The good news is that only the W-2 wages the S corporation pays to the shareholder-employee suffer federal employment taxes.

Here’s the big picture: The S corporation

- deducts the W-2 wages;

- passes the remaining taxable income to the shareholder who reports the income on his Form 1040; and

- makes cash distributions to the shareholder.

The passed-through S corporation taxable income increases the tax basis of a shareholder’s stock; therefore, distributions of corporate cash flow are usually federal-income-tax-free.

Advantage: S Corporation

This tax regime places S corporations in a potentially more favorable position than equivalent businesses conducted as sole proprietorships, single-member LLCs that are treated as sole proprietorships for federal tax purposes, partnerships, and multi-member LLCs that are treated as partnerships for federal tax purposes.

That’s because S corporations can follow the tax-smart strategy of paying modest salaries to shareholder-employees while distributing most or all of the remaining corporate cash flow to them in the form of federal employment-tax-free distributions.

Key point. Given the current reality that any proposed federal tax increase would probably face tough, if not impossible, sledding in our beloved Congress, the existing federal employment tax rules for S corporations are likely locked in through at least 2024. Good!

Quantifying the Federal Payroll Tax Savings

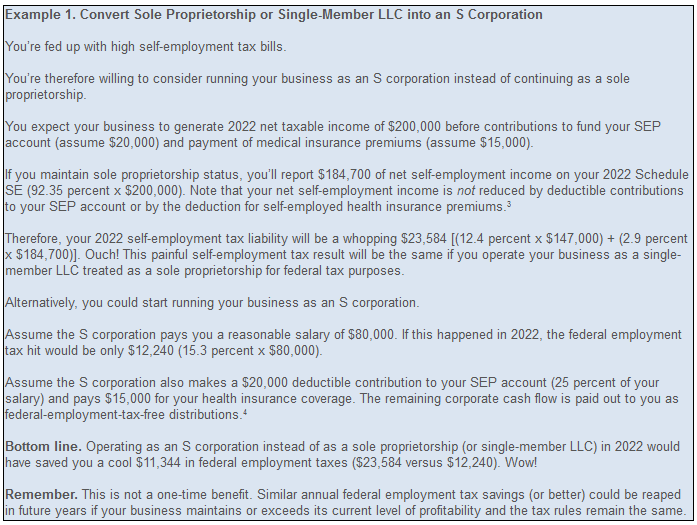

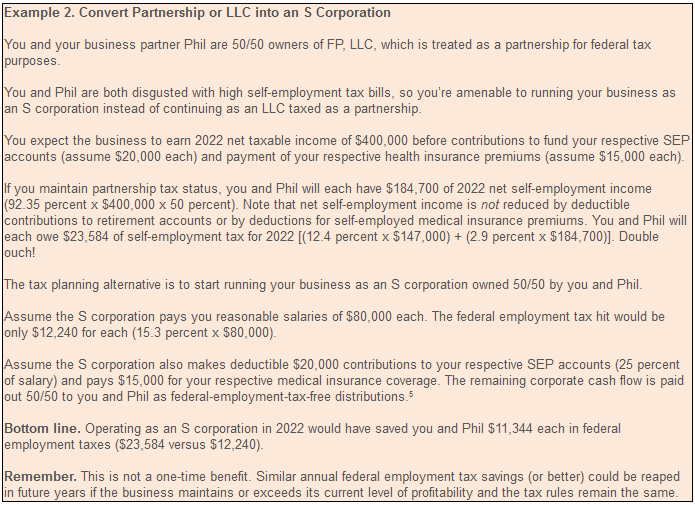

Here are two illustrative examples.

Beware of Potentially Negative Retirement Plan Side Effect

Running your business as an S corporation and paying yourself a modest salary can mean a reduced capacity to make deductible contributions to your tax-favored retirement account.

If your S corporation maintains a SEP or garden-variety profit-sharing plan, the maximum annual deductible contribution for a shareholder-employee is limited to 25 percent of salary.

Thus, the lower the salary, the lower the maximum retirement contribution.

Solution

If your S corporation sets up a 401(k) plan, paying modest salaries won’t preclude generous contributions.

- In Example 1, a deductible contribution of up to $40,500 could be made to your 401(k) account for the 2022 tax year ($20,500 employee elective deferral contribution + $20,000 employer contribution based on 25 percent of salary). If you are age 50 or older as of year-end, up to $47,000 could be contributed ($20,500 regular employee contribution + $6,500 extra catch-up employee contribution + $20,000 employer contribution). Wow!

- In Example 2, deductible contributions of up to $40,500 could be made to your 401(k) accounts for the 2022 tax year ($20,500 employee elective deferral contribution + $20,000 employer contribution based on 25 percent of salary). Ditto for Phil. If you and Phil are age 50 or older as of year-end, up to $47,000 could be contributed to your respective accounts ($20,500 regular employee contribution + $6,500 extra catch-up employee contribution + $20,000 employer contribution). Nice!

Mechanics of Converting to S Corporation Status

It may not be necessary to go through the legal step of incorporation to convert an existing domestic LLC into an entity that will be treated as an S corporation for federal tax purposes.

That’s because the IRS allows a single-member LLC or multi-member LLC that otherwise meets the S corporation qualification rules to elect S corporation status simply by filing Form 2553 (Election by a Small Business Corporation).

In this scenario, there’s no need to file a second Form 8832 (Entity Classification Election) to reclassify an electing single-member or multi-member LLC into S corporation status.

The existing LLC’s election for treatment as an S corporation must be made by filing Form 2553 no later than two months and 15 days after the beginning of the tax year for which the election is to take effect. So, it’s too late for this year. Sorry.

But if you simply missed your deadline, No Worries—Do It Now!

If the LLC is new, you have two months and 15 days from the date the entity comes into existence to file Form 2553.

Proprietorships and Partnerships

To convert an existing sole proprietorship or partnership into an S corporation, you must first form a corporation under applicable state law and contribute business assets to the new corporation as necessary.

Then, you make an S election for the new corporation by filing Form 2553 no later than two months and 15 days from the date of incorporation.

IRS Knows This Game, but Does It Matter?

As you can see, an S corporation can serve as a vehicle for mitigating federal employment taxes.

The IRS is aware of this strategy, and the tax-saving advantage is lost if the government successfully asserts that S-corporation cash distributions paid to you are disguised salary payments. Then the corporation can be hit with back employment taxes, interest, and penalties. Not good!

Twenty years ago, a Treasury Inspector General for Tax Administration (TIGTA) report said IRS auditors should be devoting substantial attention to the issue of understated compensation for S corporation shareholder-employees.

IRS audit statistics show that has not happened.

Audit rates for S corporations are still microscopic. According to the 2021 IRS Data Book (the latest one available when this was written), S corporation returns for the 2018 tax year were audited at a rate of 0.65 percent. That’s about 3 audits for every 500 returns.

While the audit risk for your S corporation may be minimal, you should still be prepared to defend stated shareholder-employee salary amounts as being reasonable (albeit on the low side of reasonable) for the work performed.

Courts Have Weighed in Too

There have been a number of court decisions on the subject of paying modest salaries to S corporation shareholder-employees to mitigate federal employment taxes.

These decisions make it clear that purported S corporation cash distributions can be recharacterized as disguised shareholder-employee compensation when stated compensation payments are unreasonably low.

The decisions, although helpful, are not as illuminating as we would like because they involve egregious compensation understatements. For a taxpayer victory on this issue, see Carol Davis where the government’s assessment of employment taxes was found to be arbitrary and capricious and was thrown out.

Bottom line. You are unlikely to lose on this issue if you gather evidence to demonstrate that you can hire outsiders to perform the same work for salaries equal to the stated (modest) salaries paid to you as an S-corporation shareholder-employee.

What About Using a C Corporation?

Good question. For a shareholder-employee of a C corporation, federal payroll taxes are due only on compensation payments—the same as with an S corporation.

But most payouts of C corporation cash flow are taxable dividends that get hit with the dreaded double taxation—where amounts paid out as dividends are taxed once at the corporate level and again at the shareholder level.

Not good!

So, as a general rule, you don’t want to use a C corporation where the corporation pays out most or all of its corporate cash flow to shareholders.

Takeaways

Because of the risk that the IRS could, after an audit, assess for underpaid federal employment taxes and tack on penalties and interest, you have to be sensitive to the issue of potentially understated compensation paid to you as an S corporation shareholder-employee.

This is especially true for a shareholder-employee of a professional service corporation, because there’s little doubt that your services drive the corporation’s cash flow.

That said, there’s precious little guidance about what constitutes an unreasonably low level of compensation in the context of S corporation shareholder-employees. And lots of talented people work hard for modest compensation.

Taking all the above into account, it seems advisable to follow a “cautiously aggressive” approach in setting salary levels for S corporation shareholder-employees. Until further notice, we believe the deck is stacked in favor of taxpayers on this issue—as long as stated salary amounts are not absurdly low.

Understand that operating as an S corporation will trigger other tax complications.

- You’ll have to file a separate annual federal income tax return on Form 1120-S and maybe an additional state income tax return.

- Transactions between S corporations and their shareholders (including asset transfers upon formation) must be scrutinized for potential tax consequences.

- State-law corporation requirements such as having board of directors’ meetings and keeping minutes must be respected.

So operating as an S corporation is no free lunch. But it can be a very affordable lunch after considering the federal employment tax savings.