You Took Coronavirus-Related IRA Money Last Year: What Now?

Tax PlanningIf you’re a traditional IRA owner who was adversely affected by the COVID-19 pandemic last year (2020), you may have been eligible to take a tax-favored coronavirus-related distribution from a traditional IRA.

If so, that privilege was thanks to the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

In this analysis, we will call these tax-favored traditional IRA distributions “CVDs.” Elsewhere, you may see them called “CRDs.”

Whatever they may be called, this analysis explains how to get the best federal income tax results. But first, let’s cover the necessary background information on CVDs. Here goes.

CVD Basics

If you were eligible, you could have taken one or more CVDs from one or more traditional IRAs in 2020, up to a combined limit of $100,000.

You can recontribute the CVD amount(s) back into one or more traditional IRAs within three years of the withdrawal date(s). You treat each withdrawal and later recontribution within the three-year window as a federal-income-taxfree IRA rollover transaction. That’s the tax advantage.

The non-tax advantage is that there are no restrictions on how you can use CVD funds. You can use the money to pay bills and recontribute later—within the three-year window—when your financial situation permits. You can help out your adult kids now and recontribute later. Whatever.

So, a CVD can be a useful tax-favored cash-management tool. Nice!

Key point. The favorable tax treatment applies equally to CVDs taken from garden-variety traditional IRAs, SEPIRAs, and SIMPLE-IRAs.

Original Eligibility Rule

According to the statutory language in the CARES Act, a CVD is a distribution of up to $100,000 from an eligible retirement plan, including an IRA, that is made between January 1, 2020, and December 31, 2020, to an individual:

- who was diagnosed with COVID-19 by a test approved by the CDC;

- whose spouse or dependent (generally a qualifying child or relative who receives more than half of his or her support from you) was diagnosed with COVID-19 by such a test;

- who experienced adverse financial consequences as a result of being quarantined, furloughed, or laid off, or having work hours reduced, due to COVID-19;

- who was unable to work because of a lack of childcare due to COVID-19 and experienced adverse financial consequences as a result;

- who owned or operated a business that closed or had operating hours reduced due to COVID-19 and experienced adverse financial consequences as a result; or

- who experienced adverse financial consequences due to other COVID-19-related factors specified by IRS guidance.

Liberalized Eligibility Rule

IRS Notice 2020-50 expanded the statutory list of individuals who were eligible to receive CVDs to include those who, in 2020, met any of the following descriptions:

- The individual had a reduction in pay or a reduction in self-employment income due to COVID-19.

- The individual had a job offer rescinded or the start date for a job delayed due to COVID-19.

- The individual’s spouse or a member of the individual’s household (1) was quarantined, furloughed, or laid off due to COVID-19, or (2) had work hours reduced due to COVID-19, or (3) was unable to work because of a lack of childcare due to COVID-19, or (4) had a reduction in pay or in self employment income due to COVID-19, or (5) had a job offer rescinded or the start date for a job delayed due to COVID-19.

- The individual, or the individual’s spouse or a member of the individual’s household, owned or operated a business that closed or reduced hours due to COVID-19.

Key point. A member of an individual’s household is someone who shares the individual’s principal residence.

Notice 2020-50 also clarified that the CVD privilege was not limited to amounts withdrawn to meet financial needs arising from COVID-19.

For example, individuals who were eligible to receive CVDs due to experiencing adverse financial consequences, as described above, could receive CVDs without regard to any actual need for funds. Furthermore, the amounts of CVDs received by such eligible individuals need not correspond to the extent of any adverse financial consequences experienced by such individuals.

The Downside: Inconvenient Interim Tax Consequences

It’s true that if you recontribute a CVD amount within the three-year window, the ultimate result is the same as a federal-income-tax-free IRA rollover.

Unfortunately, you must put up with some potentially awkward interim tax consequences before you arrive at the tax-free-rollover-equivalent outcome. The interim tax consequences can diminish the cash-management advantages of the CVD deal, and they require filing amended returns to gain federal-income-tax-free treatment.

If you take several CVDs (up to the $100,000 combined limit), the interim tax consequences apply separately to each CVD. But let’s keep things as simple as possible to make the following examples easier to understand.

Potential Negative Impact of Higher Tax Rates

As the preceding examples illustrate, you can potentially have interim tax hits in 2020, 2021 and 2022, even if you recontribute the entire CVD amount within the three-year window. Depending on political developments, federal income tax rates could be higher after 2021 and maybe even for 2021, if a retroactive rate increase is enacted. A retroactive rate increase looks fairly unlikely right now, but you never know.

If a rate increase happens, the interim tax hits under the three-year ratable income inclusion method will be that much higher. As long as you recontribute the entire CVD amount within the three-year window, you’ll eventually get back all the interim tax hits, but getting them back might not be much fun.

Tax Results If You Don’t Recontribute Within the Three-Year Window

You always have the option of simply keeping all or part of your CVD money. You’ll have taxable income from the CVD amount that you don’t recontribute. As explained in the preceding examples, you can spread the taxable income from the CVD equally over three years under the three-year ratable income inclusion method, or you can elect to report all the CVD income on your 2020 Form 1040.

If it later turns out that you have enough cash to recontribute within the three-year window, you can always decide to recontribute and recover any related federal income tax hit(s).

Good news. Regardless of what you choose to do with your CVD, you won’t owe the dreaded 10 percent early withdrawal penalty tax that generally applies to traditional IRA withdrawals taken before age 59 1/2. CVDs are completely exempt from the penalty tax.

IRS Notice 2020-50 clarifies that CVDs taken from a SIMPLE-IRA are exempt from the 25 percent early distribution penalty tax that generally applies to SIMPLE-IRA withdrawals taken before age 59 1/2.

More good news. When you recontribute a CVD amount within the three-year window, it’s deemed to be a direct trustee-to-trustee transfer that’s exempt from the one-IRA-rollover-per-year limitation.

Bad news. According to IRS Notice 2020-50, beneficiaries of inherited IRAs can receive CVDs as long as:

- they are eligible individuals,

- they can follow the three-year ratable inclusion rule to report taxable income from CVDs, and

- their CVDs are exempt from the 10 percent early distribution penalty tax.

But only an IRA CVD that is otherwise eligible for tax-free rollover treatment can be recontributed. Therefore, CVDs received by beneficiaries of inherited IRAs (other than the surviving spouse of the IRA owner) cannot be recontributed. So, no tax-free-rollover-equivalent deal for those folks. Sorry.

Tax Reporting and Procedural Issues

Notice 2020-50 stipulates the following:

- Both you and the IRS will receive a 2020 Form 1099-R that reports the amount of your CVD, even if you recontributed the entire amount to the same IRA last year.

- IRA trustees and custodians can accept recontributions of CVD amounts if they can reasonably conclude that the recontribution is eligible for tax-free-rollover-equivalent treatment under the CARES Act rules and that the recontribution is made in accordance with the rules set forth in Notice 2020-50.

- Trustees and custodians can rely on your certification that you were eligible for the CVD privilege, including the right to make tax-free-rollover-equivalent recontributions, unless the trustee or custodian has actual knowledge to the contrary.

- You become entitled to the favorable CVD tax treatment explained in this analysis by reporting your CVD on Form 1040 (if filing Form 1040 is required) and on Form 8915-E, Qualified 2020 Disaster Retirement Plan Distributions and Repayments (Use for Coronavirus-Related Distributions).

- Also use Form 8915-E to report any CVD recontributions that you made during the year and to determine the amount of CVD taxable income that you must report for the year, if any.

You must treat all CVDs received in 2020 the same way. Either all must be taxed using the three-year ratable income inclusion method or all must be reported as income on your 2020 Form 1040. You cannot make or change this election to report all CVD income on your 2020 Form 1040 after the date you timely file your 2020 Form 1040, including extensions.

If you already filed your tax return for 2020, you can make a change to your CVD treatment by filing a superseding return, as explained in Two Ways to Fix Tax Return Mistakes Before the IRS Discovers Them.

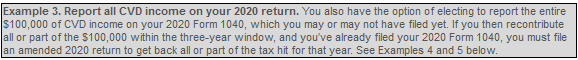

How to Handle Recontributions If You Choose to Report All CVD Income in 2020

You make the election to report all CVD income in 2020 by checking the box on Line 17 of Form 8915-E and then reporting the entire amount of your CVD(s) as income on your 2020 Form 1040.

If you then recontribute all or part of the CVD amount on or before the due date of your 2020 Form 1040 (including any extension), don’t report the recontributed amount as gross income on your 2020 return.

If instead you recontribute all or part of the CVD amount after the due date of your 2020 Form 1040 (including any extension), you must file an amended 2020 return to remove the recontributed amount from your 2020 gross income and thereby recover the related 2020 tax hit. The amended return must include Form 8915-E to report the recontribution. See Examples 4 and 5 below.

How to Handle Recontributions If You Use the Three-Year Ratable Income Inclusion Method

As mentioned earlier, you can spread the income from CVDs equally over three years, starting with 2020. If you then recontribute any CVD amount within the three-year window before the Form 1040 due date for the year of the recontribution (including any extension), the amount of the recontribution reduces the ratable income inclusion amount that’s reported on that year’s return. See Examples 6 and 7 below.

What’s the Best CVD Strategy for 2021-2023?

Good question. The interim tax consequences for CVDs are inconvenient at the very least, and they can seriously reduce the cash-management advantage of the CVD privilege. But consider the following strategies:

- If your 2020 taxable income was much lower than usual due to COVID-19 economic fallout, you might have a very manageable federal income tax hit from including the CVD income on your 2020 Form 1040. You’ll have extra cash in hand. Later, you can recover some or all of the 2020 tax hit by recontributing some or all of the CVD amount within the three-year window and getting the recontributed amount back into tax-favored IRA status. Or you can just keep all the cash and live with the 2020 tax hit.

- If you had negative 2020 taxable income because of business losses due to COVID-19 economic fallout, reporting all the CVD income on your 2020 Form 1040 could be a very tax-smart move if you can shelter most of or all that income with business losses. You will have extra cash in hand and will owe little or no federal extra income tax for 2020. If you have sufficient cash later on, you can recontribute all or part of the CVD amount within the three-year window, recover all or part of any 2020 tax hit, and get the recontributed amount back into tax-favored IRA status.

If you recontribute the CVD amount sooner than required, it will mitigate unfavorable interim tax consequences, as illustrated by some of the preceding examples.

Key point. For any CVD amount that was not recontributed by December 31, 2020, you have until October 15, 2021, to make the decisions that will determine how that amount will be taxed, as long as you extended the deadline for filing your 2020 Form 1040 to October 15, 2021. Or, if you have already filed, you could file a superseding return.

Takeaways

In the right circumstances, taking advantage of the CVD privilege can be a good, tax-smart financial planning strategy. Some “experts” scoff at that statement, because they think taking money out of an IRA before retirement is always a terrible idea. But we stand by the statement.

That said, if you don’t recontribute CVD amounts by the due date for your 2020 Form 1040, there can be inconvenient interim tax consequences. Or not. It depends on your specific circumstances.

For any CVD amount that was not recontributed in 2020, you have until October 15, 2021, to make the decisions that will determine how that amount will be taxed, as long as you extended the deadline for filing your 2020 Form 1040 to October 15, 2021 (or you file a superseding return).